If you create an invoice for your guest and he doesn’t pay the (full) invoice on check-out, he owes you money. An accountant would call this amount “accounts receivable”.

How can I account for accounts receivable?

Let’s say a booking is worth $100.

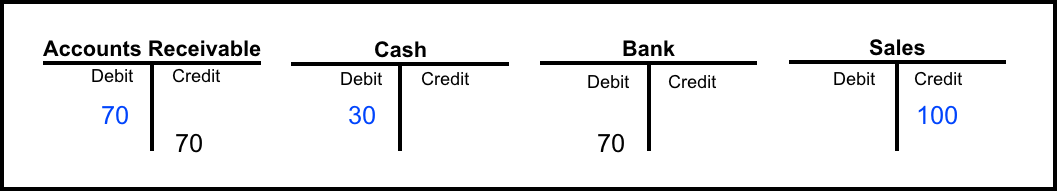

- On check-out the guest pays $30 immediately and you create an invoice with “7 days NET” – which means the guest has 7 days to pay the other $70. From an accounting perspective, this is when the actual sale takes place. So the accountant debits $70 in the “Accounts Receivable” ledger account and $30 in the “Cash” ledger account. He also credits $100 in the “Sales” ledger account. (All in blue below.)

- Five days later the guest pays the other $70 via bank transfer. Now the accountant debits the “Bank” ledger account and credits the “Accounts receivable” with $70. (In black below.)

The ledger accounts would look like this at the end of the process:

In Sirvoy you can find a summary of all the ledger accounts (including accounts receivable) under Invoicing -> Accounting Report.