If your guests pay online at the time of booking, the amount paid is automatically registered as a payment note in that booking. You can also register a (pre)payment by manually clicking “Add payment note.”

Use Payment Notes for Two Purposes:

- As informal notes. Leave them in a booking and don’t include them in the accounting report. This way, they will act as a post-it note saying, “This guest has already paid $100.”

- As part of formal fiscal documents. Include them in the accounting report. This way prepayments will be included in your bookkeeping. From an accounting perspective, prepayments will be considered debts; the guest is owed the service they have already paid for.

To accommodate both needs, you can select if you want to include prepayments or not when you create an accounting report under Invoicing -> Accounting report. There, you have to enable “Include invoice payments” in order to then enable “Include payment notes”.

Let’s use the following example to see the results of excluding or including payment notes.

Example Situation:

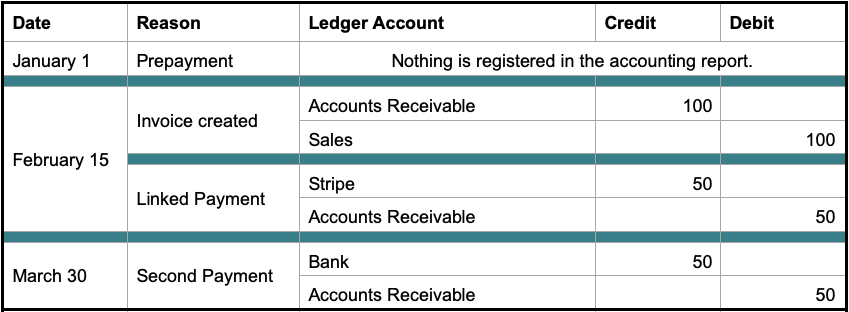

Payment Notes are Excluded

If Include payment notes is not selected when creating the accounting report, it will only include payments that have been linked to a cash receipt or invoice. The example situation would be registered as:

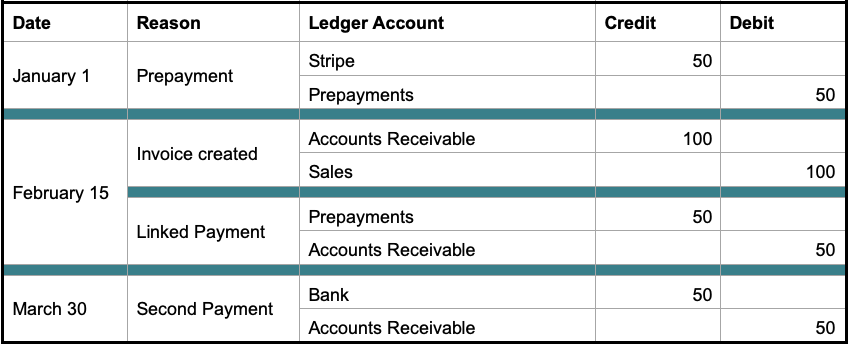

Payment Notes are Included

If Include payment notes is selected when creating the accounting report, it will include all payments registered in Sirvoy. Those payments will appear in the report with their registration date.

The example situation would be registered as: